Auto Summit Consulting, helping new car buyers reach their peak car buying experience.

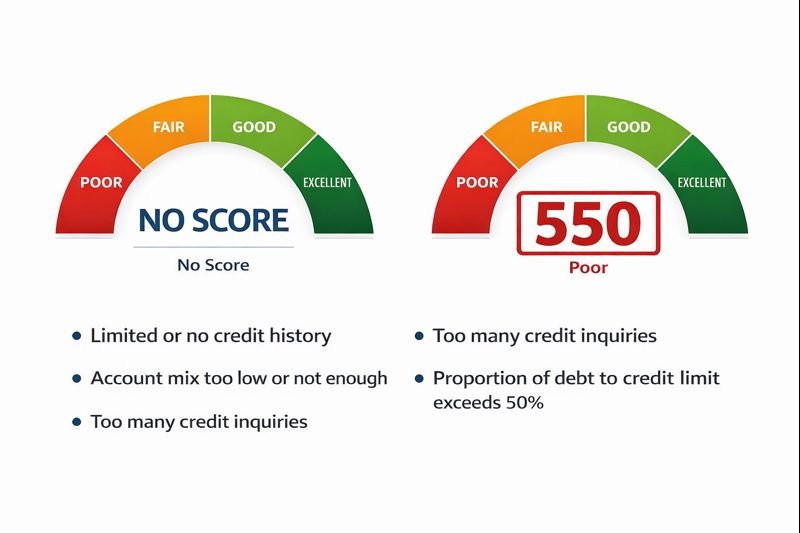

Does your credit profile look similar due to being new to credit or minimal credit accounts?

What is ”Shotgunning your credit ” and why can it be devastatingly horrible on your credit and future options ?

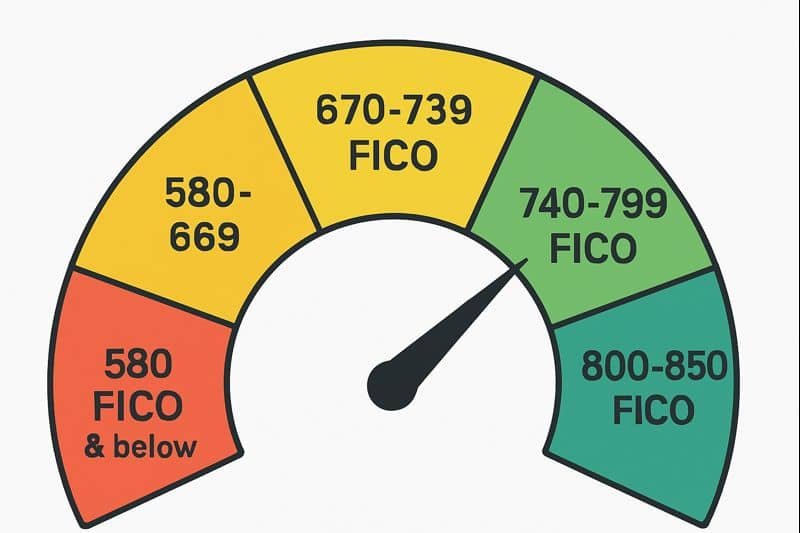

Each F.I.C.O tier gives Lenders/Banks a quick understanding of what consumer they are assessing to lend. The higher your score tier ranks ( your score range ) the more likely you are to be approved & pay less in interest on whatever credit product you are applying for.

Just like a hunter with a shotgun filled with buckshot, a car dealership shops your credit reports like ( buckshot) as multiple scattered bullets, increasing the chance of hitting/sticking to a bank, optimizing their search if you will. Essentially, they are just waiting to see what will stick (as in what bank will approve the car loan). Not to mention these lenders/banks who partner with the dealerships fight ( in an aggressive bidding war to fund your loan ), although that might sound good, it definitely is NOT good.

And if any those reports has more than 6 credit inquiries within a 2 year period, most computer based software will auto decline your application because it sees you as desperate or high risk. It would take a Bank underwriter to overturn the previous decision. But how is it going to be overturned in your favor if you have little to no credit history & a low score?

This can easily become a lose-lose situation, and can leave a person utterly hopeless in their car buying experience. Some may be approved… sure! But at What cost? You can very easily and quickly find throughout multiple media platforms, I.E – Tiktok, Instagram, Facebook and Youtube where people are being preyed on with OBSCENE FEES and interest charges for the duration of their car loans.

America has a huge car debt problem, and most people want to point the finger immediately to the customer. and to some degree adults SHOULD read before they sign yes, but on thee other hand no one is being taught finance and credit for the most part in schools. Complicated contracts (which some lawyer can’t even understand), and an adversarial type of enviroment at the car dealership draining you of your time, patience and negotiating fortitude needed to get the best deal!

HOW OUR CONSULTING WORKS

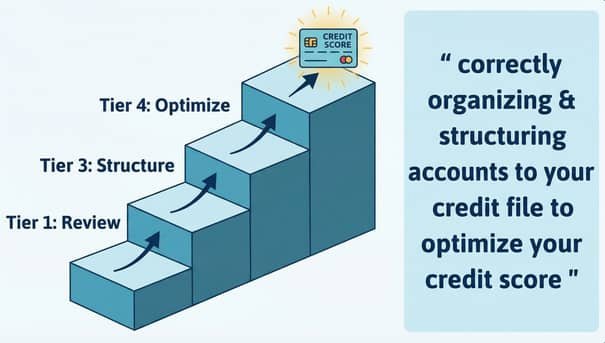

Our 3-Step Credit Consulting Process

Credit Review & Strategy

We assess your F.I.C.O-based credit reports and build a personalized plan to structure your credit properly.

Credit File Structuring

You are guided on adding the correct accounts and organizing them to improve lender perception.

Credit History Optimization

Over the following months, we help you establish positive payment history and utilization to strengthen approval odds.

(Frequently Asked Questions)

FAQ

What exactly does Auto Summit Consulting do?

How long does it take to see credit improvement?

Do you guarantee loan approval?

Will I need to spend money outside of your consulting fee?

What type of income do banks require?

Can you help me find a car as well?

Ready to Improve Your Approval Odds?

Start with a professional credit consultation and take the first step toward auto loan approval.