About Auto Summit Consulting

Who We Are

Hello, my name is Dan Perez, and I am the owner and operator of Auto Summit Consulting.

In my mid-20s, I began developing a deep understanding of the nuances and importance of credit. This interest led to years of dedicated research into how a credit report must be structured, corrected, and optimized in order to become a good-to-great credit profile.

I went on to operate a licensed credit repair company in Washington State for several years, fully compliant with FDCPA, FCRA, and CROA regulations. These laws not only governed my work, but also empowered me to advocate effectively on behalf of my credit repair clients. While the work was rewarding, credit repair required an extensive time commitment often taking months to over a year to achieve meaningful results, depending on the severity of the negative information involved. After several years, I decided to pursue a different direction.

Even after closing my business, I continued helping friends and family. With years of knowledge and experience in credit, it felt wasteful not to apply what I had learned. That realization led me to identify a largely underserved market: high school graduates, college students, young adults entering the workforce, and individuals with little to no credit history.

The reality is that credit and finance are not taught in sufficient depth within common culture or the U.S. education system. Many people are never taught how to understand contracts, the usury behind interest rates and APRs (Annual Percentage Rates), or how a credit report and the score derived from it determines whether a lender views you as a worthy borrower.

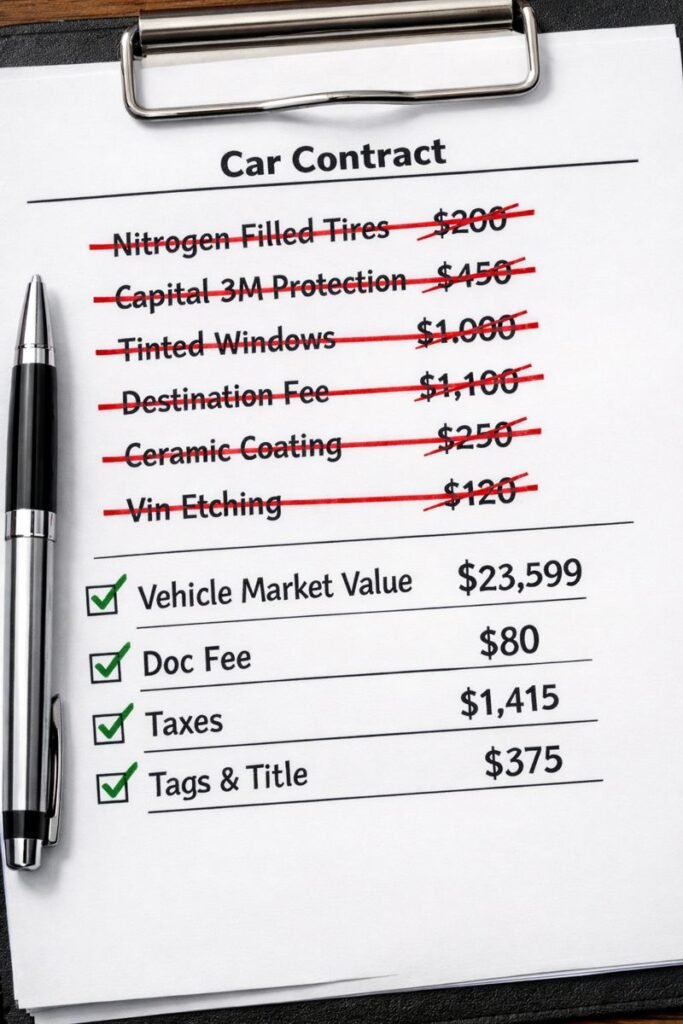

At Auto Summit Consulting, my vision is to break down these barriers by helping individuals within these demographics achieve true credit literacy, build good-to-great FICO® scores, and ultimately secure approval for a vehicle that is truly worth purchasing. My goal is to help clients avoid financial hardship caused by low credit scores and high interest rates outcomes that often occur when navigating the process alone.

Let me help you secure a great deal. One you can look back on years from now, knowing it was the right decision & with zero regrets!

Our Vision

To become a trusted consulting partner for individuals seeking financial independence through responsible credit building. We envision a future where first-time buyers and young adults understand how to position themselves correctly for auto financing and make informed financial decisions without unnecessary stress or confusion.

Our Core Values

Bank-Focused Consulting

Our strategies are built around real lender requirements not assumptions.

Professionalism:

Our consulting will undoubtedly be ethical, and knowledgeable to position your credit at the best possible score within the time required prior to the car buying experience.

Consistency:

When you follow the structured program, the success will separate you from others within your same demographics. ”Separation is in the preparation”.

Excellence:

We aim for the highest standards, allowing you to come out the victor in the car buying process!

Ready to start your 3-month countdown?

*Although your credit score may rise to between 670-740 range. This will not automatically mean you can get approved. It is imperative, that the customer let the consultant advice on how to overcome the last hurdle to be credit worthy and have better success for an approval.